The Families First Coronavirus Response Act passed in March of 2020 detailed a new law requiring small employers to provide limited paid leave benefits to employees affected by the coronavirus pandemic. For affected self-employed individuals, it allows them to claim a refundable tax credit to offset their federal income tax.

If you are self-employed and were unable to work or telework this past year for reasons relating to your own health or to care for a family member, you may be eligible for a refundable tax credit. To be eligible, you must conduct a trade or business that qualifies as self-employment income and meet the requirements to receive qualified sick or family leave wages under the Emergency Paid Sick Leave Act or Emergency Family and Medical Leave Expansion Act as if you were an employee of a business.

Up to ten days total paid sick leave is available if you

Were subject to a government quarantine or isolation order Were directed by your doctor to self-quarantine Had coronavirus symptoms and were seeking a medical diagnosis

The credit is worth the lesser of $511/day or 100% of your average daily self-employment income for the year per day. (An individuals’ average daily self-employment income is equal to the net earnings from self-employment for the taxable year divided by 260.)

Up to 50 days of emergency family leave is available if you

Needed to care for a family member that was advised by their doctor to quarantine or was subject to a quarantine order Lost childcare due to coronavirus-related daycare or school closures or the provider was unavailable due to coronavirus precautions Experienced any other substantially similar condition specified by the Secretary of Health and Human Services

This credit is worth the lesser of $200/day or 67% of your average daily self-employment income for the year per day.

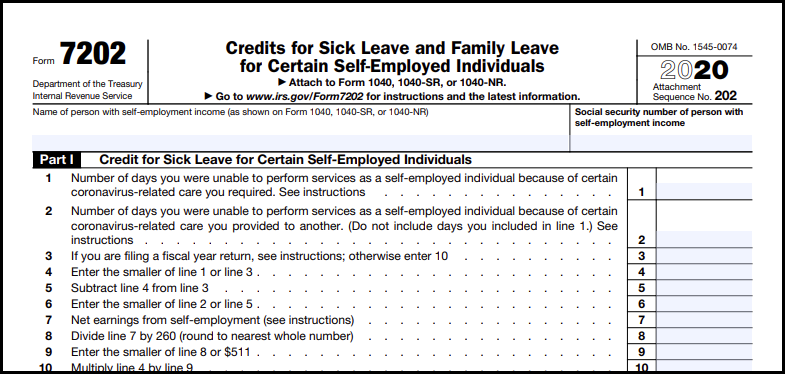

Both credits can be claimed for separate days if applicable, for a total of up to 60 days paid leave. The credits are calculated on the new Form 7202, attached to your Form 1040. These credits cover days you could not work between April 1 and December 31, 2020 for tax year 2020 and January 1 to March 31, 2021 for tax year 2021.

If you are both an employee and self-employed, self-employed individual credits are reduced for any benefits you receive as an employee.

Your Bacon & Gendreau tax professional can help determine your eligibility for these tax credits during your tax preparation appointment. Bring records for the time you could not work along with your self-employment business income and expense records. Federal tax filing begins February 12, 2021. If you haven’t already made arrangements with our office, call today to reserve your appointment.