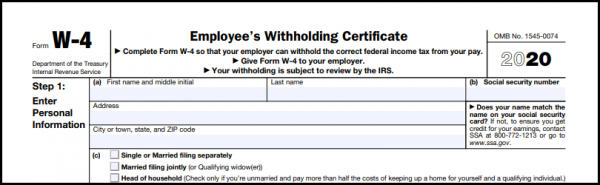

This new Employee’s Withholding Certificate has been in the works since the passage of the Tax Cuts and Jobs Act of 2017. The redesigned version no longer uses allowances due to the law change ending personal and dependent exemptions. The IRS intended to reduce the form’s complexity and increase the transparency and accuracy of the withholding system.

The “less complex” form

The new withholding form is a bit like a mini tax return. You will choose your filing status, estimate your total household income across all jobs, claim dependents, and optionally account for non-wage income and deductions.

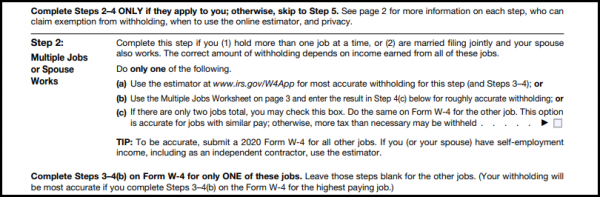

Multiple income households

Among the changes are 3 calculation options for determining base withholding for multiple jobs or two-income households.

Option (a):

Use the IRS provided Tax Withholding Estimator. You will need your most recent pay stubs for all your and your spouse’s jobs and information on any other sources of income. Your most recent tax return will be helpful. Using the estimator will result in the most accurate withholding calculations. It will also protect your privacy by limiting the information given to your employer in the subsequent steps. The estimator will provide instructions on filling out new W-4s for all jobs.

Option (b):

If you don’t wish to use the estimator or do not have access, use the attached worksheet to make reasonably accurate calculations manually.

Option (c):

If your household has only two jobs of similar pay, you can use the checkbox provided on the form. The standard deduction and tax bracket will be divided equally between the two jobs. The more similar the pay is, the more accurate the withholding will be.

If you have a tax situation that is too complex for the tax estimator or the provided worksheet, you will need to use the instructions available in Publication 505: Tax Withholding and Estimated Tax or make an appointment with a tax professional.

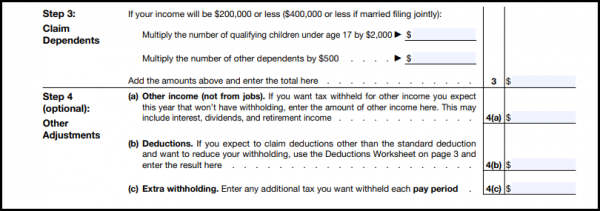

Dependents and other adjustments

If you’ve chosen Step 2(b) or 2(c), Steps 3 and 4 ask for your child and dependent credit information, any other non-wage income you want tax withheld from, and any deductions you plan to take. If you do not want to report this information to your employer, you can leave all the lines blank, use the tax estimator, and write its result on line 4(c).

These steps should usually only be completed for the highest paying job in a multiple income household.

You can also choose to omit Step 4(a) and (b) here and pay any additional taxes you will owe quarterly. If your situation is complex, make an appointment with your tax professional to go over your withholding and estimated payment schedule.

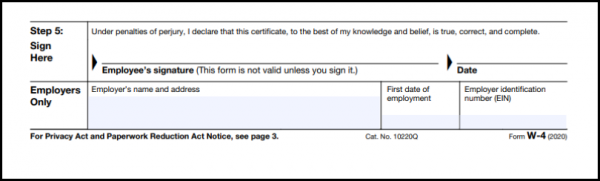

Do I need a new W-4?

Employees are not required to submit a new 2020 Form W-4 to their employers. Your current withholding elections will remain in effect. It is, however, a good idea to review your withholding annually, and we recommend you consult the IRS Tax Withholding Estimator after you receive your January paychecks to see if adjustments should be made.

You should also recheck your withholding:

- After any big life event (marriage, divorce, new child, home purchase, etc.)

- If you received a large refund or had a large unexpected balance due on your last return

- Whenever you or your spouse change jobs

- Any time a there is a change in federal or state laws that may affect your tax liability

If you need professional help with your withholding, call our office at 860-216-2195 for an appointment.