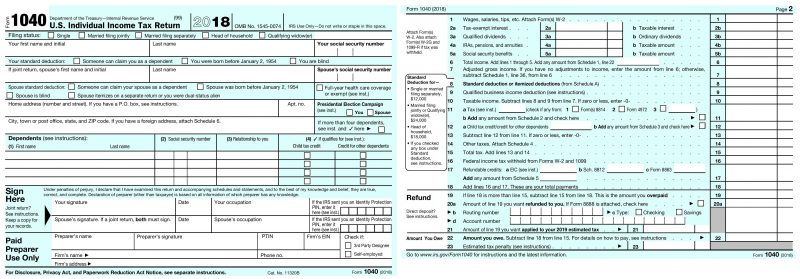

If you have already had your tax preparation appointment, you might have noticed the new Form 1040. The new form was created to meet the challenge of efficiently representing the many changes that took effect for tax year 2018.

One 1040 for all

Taxpayers who previously filed using Form 1040A or 1040EZ will notice that they are no longer available. All individual taxpayers will file using the new version of Form 1040.

Shorter form, more add-ons

While it’s not quite postcard size, the new form is shorter than previous versions and condenses the key details to about half a page front and back. It contains your personal and dependent information and an 18-line summary of the calculations of taxes paid and owed, followed by your final refund or balance.

Those with the most basic tax situations will stop here. For everyone else, the IRS still requires most of the specific details as before. The new system accomplishes this by moving information previously contained on Form 1040 onto six new schedules. Taxpayers will attach only those schedules which apply to them.

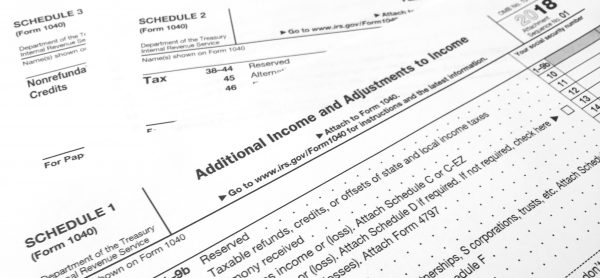

Schedule 1 Additional Income and Adjustments to Income

IRA contributions, alimony received or paid, student loan interest, HSA contributions, business or rental income, etc. are reported here. Some additions or adjustments still require their own specific schedule or form to be attached as before.

Schedule 2 Tax

This schedule is used for the Premium Tax Credit for marketplace healthcare premiums and for the Alternative Minimum Tax. In either case, an additional form is required along with this schedule.

Schedule 3 Nonrefundable Credits

This schedule condenses credits including care expenses, education credits, energy credits, etc. In all cases a separate form calculating each individual credit is also required.

Schedule 4 Other Taxes

This schedule summarizes calculations of other taxes owed for the year, including self-employment taxes, unreported social security and Medicare taxes, taxes on investment income, household employment taxes, etc. Each is calculated on another schedule or form.

Schedule 5 Other Payments and Refundable Credits

Estimated tax payments made, or payments sent with an extension are reported here along with specific refundable credits.

Schedule 6 Foreign Address and Third Party Designee

This schedule is only needed if you have a foreign address or wish to allow another person to talk to the IRS on your behalf.

As the information contained on the new 1040 and these accompanying schedules is largely the same as the old form, unless they are filling out paper forms by hand most taxpayers will not notice much of a difference in difficulty or time required to complete.

The original schedules are here to stay

The rest of the alphabet soup of 1040 schedules remain largely unchanged and will still be required whenever applicable in addition to the new Schedules 1-6.

As always, if you are a client with questions give us a call or email your Bacon & Gendreau tax professional. If you still need to schedule your 2018 tax preparation appointment, call us today at 860-216-2195.