September is FEMA’s National Preparedness Month. Emergencies and neighborhood evacuations can occur anywhere, at any time of year. While many of your personal and financial documents can eventually be replaced, your family’s recovery from a disaster will be faster and smoother if you take a little time to prepare now.

The IRS offers these tips to help taxpayers prepare for and respond to a disaster:

Safeguard your identity documents and vital records and have them ready to travel.

Birth certificates, Social Security cards, passports, marriage certificate, divorce decree, citizenship documents, custody papers, military discharge paperwork, insurance policies, real estate deeds, estate documents, and vaccination records and microchip numbers for any pets should be stored accessibly in your home, ready to take with you on a moment’s notice. A waterproof, fireproof safe or a locking filing cabinet are your best choices; a safety deposit box is not necessarily recommended because you may not be able to retrieve your documents quickly enough.

Birth certificates, Social Security cards, passports, marriage certificate, divorce decree, citizenship documents, custody papers, military discharge paperwork, insurance policies, real estate deeds, estate documents, and vaccination records and microchip numbers for any pets should be stored accessibly in your home, ready to take with you on a moment’s notice. A waterproof, fireproof safe or a locking filing cabinet are your best choices; a safety deposit box is not necessarily recommended because you may not be able to retrieve your documents quickly enough.

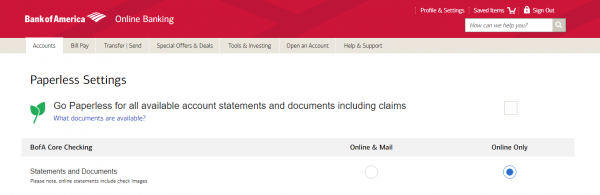

Take advantage of paperless recordkeeping for financial and tax records.

Sign up for online banking and register for paperless statement delivery for your financial accounts whenever possible. Request PDF copies of all your insurance policies (home, renters, auto, flood, life, medical, disability, liability). Scan important paper tax records, such as W-2s and federal and state tax returns. The IRS can provide you with a transcript of your return from the last seven years, but their records may be incomplete and do not include supporting documents. Keep these either in secure cloud storage or in a physical format (CD, external hard drive, USB flash drive) in a fire safe. You can also keep duplicate copies of physical formats with a family member in another region.

Document valuables and business equipment.

There are numerous apps and internet resources to help you inventory your personal and business’ physical assets. Scan any appraisal documents and large purchase receipts and take photographs or video of your home room by room and store them digitally. They will be invaluable when making insurance claims or filing any losses on your tax return. Back up your business’ computer data systems regularly to off-site storage.

Give with caution.

Whenever a disaster happens, scammers are not far behind. Be wary of anyone soliciting door to door or over the phone. Always verify the organization and contact information, and confirm that you are communicating with a legitimate representative. Check the credentials of potential organizations or individuals, such as searching for their rating on Charity Navigator. For tax purposes, only gifts to qualified charities are deductible, and you need to keep accurate records and documentation.

Whenever a disaster happens, scammers are not far behind. Be wary of anyone soliciting door to door or over the phone. Always verify the organization and contact information, and confirm that you are communicating with a legitimate representative. Check the credentials of potential organizations or individuals, such as searching for their rating on Charity Navigator. For tax purposes, only gifts to qualified charities are deductible, and you need to keep accurate records and documentation.

Taking steps to protect your vital documents and records can mean a quicker recovery for your family after a disaster. If you own property impacted by a federally-declared disaster, the IRS Disaster Assistance and Emergency Relief page has resources to help. For more information on preparing your home and business this National Preparedness Month visit ready.gov.